How To Invest In Bonds Includes Understanding the History, Mechanics, and Potential Returns

Want to strengthen your portfolio’s risk-return profile? This comprehensive guide on how to invest in bonds can create a more balanced portfolio by adding diversification and calming volatility.

What Are Bonds?

Bonds are an essential component of the financial market, serving as a popular investment option for individuals, corporations, and governments alike. This article will explore the fundamentals of bonds, their historical significance, mechanics, and the typical returns they offer investors.

Bonds are debt instruments issued by governments, municipalities, and corporations to raise capital. When investors buy bonds, they lend money to the issuer in exchange for regular interest payments (coupons) and the return of the principal amount at maturity. Bonds have specific terms, including maturity date, face value, coupon rate, and payment frequency.

How Bonds Work

Want to strengthen your portfolio’s risk-return profile? Bonds can create a more balanced portfolio by adding diversification and calming volatility. However, the bond market may seem unfamiliar even to the most experienced investors.

Many investors need help understanding how to invest in bonds and make only passing attempts because they need clarification on the apparent complexity of the bond market and terminology. In reality, bonds are straightforward debt instruments. So, how do you get into this part of the market? Get your start in bond investing by learning these basic bond market terms.

KEY TAKEAWAYS

- The bond market can help investors diversify beyond stocks.

- Some of the characteristics of bonds include their maturity, coupon (interest) rate, tax status, and callability.

- Bond risks are associated with interest rate risk, credit/default risk, and prepayment risk.

- Most bonds come with ratings that describe their investment grade.

Historical Significance of Bonds

Bonds were essentially loans assignable or transferrable to others, appearing as early as ancient Mesopotamia. The recorded history of debt instruments dates back to 2400 B.C. via a clay tablet discovered at Nippur, now present-day Iraq. This artifact cites a guarantee for payment of grain and the consequences if the debt was not repaid.

In the Middle Ages, governments issued sovereign debt to fund wars. The Bank of England, the world’s oldest central bank, was established to raise money to rebuild the British navy in the 17th century through bonds. The first U.S. Treasury bonds were issued to help fund the military, first in the war of independence from the British crown, and again in the form of “Liberty Bonds” to raise funds to fight World War I.

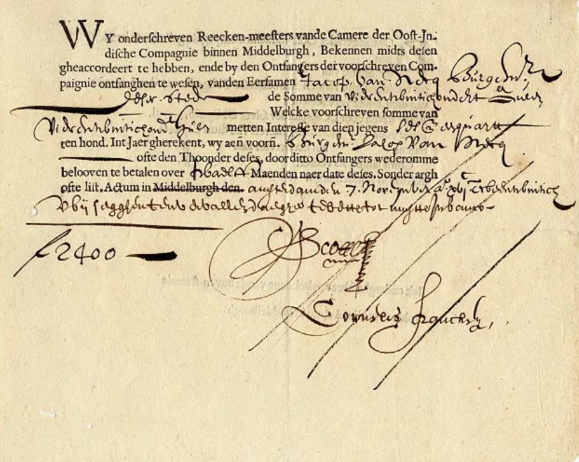

The picture above features a bond from the Dutch East India Company (VOC), dating from Nov. 7, 1623. The VOC was the first company in history to issue bonds and shares of stock widely to the general public.

Early chartered corporations such as the Dutch East India Company (VOC) and the Mississippi Company issued debt instruments before they issued stocks. These bonds, such as in the image above, were “guarantees” or “sureties” and were hand-written to the bondholder.

Types of Bonds

In finance, bonds represent a beacon of stability and security. Bonds come in many forms, each with unique characteristics and advantages. With so many choices available, it’s essential to understand how to invest in bonds and the subtle but significant differences among the most common types.

Corporate Bonds

Corporate bonds are fixed-income securities issued by corporations to finance operations or expansions. Private or institutional investors who buy these bonds choose to lend funds to the company in exchange for interest payments (the bond coupon) and the return of the principal at the end of maturity.

The risk and return of corporate bonds vary widely, usually reflecting the issuing company’s creditworthiness. This makes due diligence essential before investing in one.

Treasury Bonds

Treasury bonds are long-term investments issued by the U.S. government. They have a maturity of 10, 20, or 30 years. Therefore, the U.S. backs these bonds and is regarded as very safe. Due to their low risk, they offer lower yields than other types of bonds. However, when market interest rises, the prices of these longer-running and lower-yielding bonds can come quickly under pressure. Investors use Treasury bonds as a secure long-term investment.

International Government Bonds

International government bonds are debt securities issued by foreign governments. They allow investors to diversify their portfolios geographically and potentially benefit from currency fluctuations or higher yields. Depending on the country or region, they can have additional risks, including political instability, exchange rate volatility, and many others, making them a comparatively riskier investment choice.

Municipal Bonds

Municipal bonds ( called “munis”) are debt securities issued by states, cities, or counties to fund public projects or operations. Like other types of bonds, they can also provide steady interest cash flow for investors. Additionally, these bonds typically offer tax advantages since the interest earned is frequently exempt from federal and sometimes state and local taxes.

Agency Bonds

Government-sponsored enterprises or federal agencies generally issue agency bonds. Although not directly backed by the U.S. government, they have a high degree of safety because of their government affiliation. These bonds finance public-purpose projects and usually have higher yields than Treasury bonds. However, they may carry a call risk, meaning the issuer can repay the bond before its maturity date.

Bond ETFs

Bond ETFs specifically invest in bond securities. They can offer broad diversification within the bond community, and an ETF may hold various bonds. This provides liquidity, price transparency, and lower investment thresholds than individual bonds. However, like individual bonds, they’re subject to interest rate and credit risk, among other risks.

Bond Returns and Risks

Bonds can be a great tool to generate income and are widely considered to bea safe investment, especially compared with stocks. However, investors should be aware of the potential pitfalls of holding corporate bonds and government bonds. Below, we’ll discuss the risks that could impact your hard-earned returns.

KEY TAKEAWAYS

These are the risks of holding bonds:

- Risk #1: When interest rates fall, bond prices rise.

- Risk #2: Having to reinvest proceeds at a lower rate than what the funds were previously earning.

- Risk #3: When inflation increases dramatically, bonds can have a negative rate of return.

- Risk #4: Corporate bonds depend on the issuer’s ability to repay the debt, so there is always the possibility of default of payment.

- Risk #5: A low corporate credit rating may cause higher interest rates on loans and therefore impact bondholders.

- Risk #6: Low liquidity in some bonds can cause price volatility.

Bond Investment Strategies

To the casual observer, bond investing is as simple as buying the bond with the highest yield and holding it until it reaches maturity. While this works well when shopping for a certificate of deposit (CD) at the local bank, it only works in the broader world of debt investing.

Several options are available for structuring a bond portfolio, and each strategy comes with its own risk and reward tradeoffs. The four principal strategies used to manage bond portfolios are:

- Passive, or “buy and hold”

- Index matching, or “quasi-passive”

- Immunization, or “quasi-active”

- Dedicated and active

KEY TAKEAWAYS

- Owning a bond portfolio can generate steady income, but bond prices are sensitive to interest rate changes.

- An active approach requires staying ahead of interest rate moves.

- An immunization approach reduces the impact of interest rate changes on a portfolio’s value.

Factors Influencing Bond Returns

The economic factors influencing corporate bond yields are interest rates, inflation, the yield curve, and economic growth. Corporate bond yields are also influenced by a company’s metrics, such as credit rating and industry sector. All of these factors affect corporate bond yields and exert influence on each other.

The pricing of corporate bond yields is a multivariate, dynamic process in which there are always competing pressures.

KEY TAKEAWAYS

- Corporate bond yields indicate the relative riskiness of the issuing company but are also influenced by macroeconomic factors.

- Economic growth and low inflation are positive for corporations, and so they have a downward effect on bond yields.

- When economies grow, however, target interest rates may be increased as inflation rises, which puts positive pressure on yields.

Wrap-Up: Whether you’re a conservative investor looking for stable income or seeking to balance risk in your portfolio, bonds offer a compelling asset class to explore. Investors can effectively incorporate these debt instruments into their investment strategies by comprehending the intricacies of bonds and staying informed about market trends.

Disclaimer: The information in this article featuring how to invest in bonds is strictly for educational purposes only and should not be considered financial advice. It is recommended to consult with a qualified financial professional before making any investment decisions.

Get In Touch

Leeb Capital Management offers no-obligation consultations with an investment professional.