Navigating The Stock Market’s Volatility Will Depend On Following One Simple Investing Rule

Economists have immense models to forecast and gauge inflation. Fortunately, investors can get by with just one simple rule:

Buy and hold stocks when the Producer Price Index (PPI) 12-month rate of change is below 4.25%.

Sell when the rate of change rises above 4.25%.

The CPI measures price changes for a basket of goods and services typically purchased by the ordinary consumer. The PPI is closer to the root of inflation because it gauges price changes in materials used to make those goods and services, such as machinery used in creating consumer goods.

Keynote: Price changes in the PPI foreshadow price changes in the CPI, making it a better indicator of inflation.

Historically, when the PPI is below 4.25%, it’s indicative that inflation is under control. It suggests current economic growth is sustainable. Businesses can plan on expanding, corporate earnings will rise, and stock prices will soar.

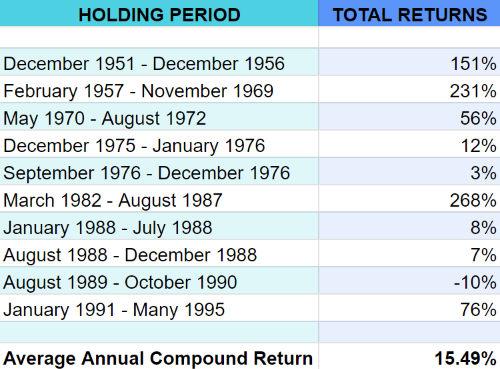

The example of the Average Annual Compound Rate Of Return from 1951 to 1995 bears this out, as you can see in the table “Buy Low, Sell High.”

BUY LOW, SELL HIGH

If you had bought and held stocks only when the PPI was less than 4.25% – disregarding other variables – your investment would have compounded at an average annual rate of 15.49%. That’s well above the market’s average long-term return of around 9%.

The second half of our guideline is to sell stocks when the PPI rises above 4.25%. The idea here is that when the PPI gets out of control, an increase in inflation isn’t far ahead.

If you had bought and held stocks during all the periods when the PPI was above 4.25% since WW2, your average annual total return would have been just 1.8%. Excluding dividends, you would have lost money. Including inflation, you would have lost money big-time.

To capture even that paltry 1.8% return, you would’ve had to hold on tight through some of the most gut-wrenching bear markets of the past 50 years.

Several examples include:

- 1969/70 stock market decline

- Massive market sell-off of 1973/74

- Autumn stock market crash in 1987

It has behooved investors to follow our simple rule to the letter, whether the market’s long-term trend has been up or down.

During the inflationary 1970s, PPI growth was above 4.25% most of the time. There were just three different buy signals, and each was short-lived. To sell was the prudent course most of the time.

America’s root economic problems today are much worse than during the 1970s. That means more volatility and inflation lie ahead. It will be even more imperative to keep up with this vital indicator.

Current CPI and PPI statistics are announced monthly by the U.S. Dept. of Labor.

Signals To Buy

When the PPI signals it’s time to buy, what stocks should you choose? We’ve based all of our calculations on the performance of a very broad-based market average, the S&P 400 industrials index. These 400 stocks represent most of the market’s typical volume, making them a good proxy for the average stock.

Some stocks will radically outperform the averages in the years ahead. On the other hand, some will dramatically underperform. Taking full advantage of our simple rule, you don’t have to be a stock picker. You simply have to ensure your portfolio reflects what’s most likely to happen in the market averages- the Dow Jones and the S&P. That means diversification.

How you diversify is a matter of personal preference and financial objectives. The easiest way to diversify is through professionally managed, big-cap stock mutual funds. These funds allow you to own a broad-based portfolio for a relatively low initial investment, typically $1,000 to $3,000.

The key here is to, at a minimum, match the big-cap stock averages when there is a green light to buy. For example, buy when inflation sits below 4.25% and sell when it moves above 4.25%.

It may be possible to do better than an index fund if you pick your funds wisely. There are many quality funds worth looking into. There are no-load funds – which charge no fees to buy or sell shares – and have experienced managers who have beaten the averages in both bull and bear markets.

Here are some savvy guidelines:

Ideally, funds should be no-load, imposing no sales charges or redemption fees.

Many exceptional stock funds charge an upfront fee for new investments. Albeit, there are many funds of equal caliber that don’t. In a market where extreme volatility spells the end of buy-and-hold as a viable investment strategy, you’ll need maximum flexibility to move in and out of your fund.

Funds that impose withdrawal penalties or bill you for moving back in will make it too tempting to hold on and hope for the best. That could be a financial mistake that could take you years to recover. The best practice would be to stick with no-load funds.

Funds should beat the S&P 400 industrials index in both bull and bear markets.

A rising tide raises all ships, and a falling tide lowers them. But if a fund has beaten the major average in both up and down markets over the long haul, managers have shown they have the knack for picking good stocks over a multi-year period.

Funds should be adequately diversified, with a nominal r2 of 70.

One often overlooked caveat is having a fund overly committed to just a few stocks or particular sectors. To research whether a fund is adequately diversified, check its “r2” (R-squared) stats. R2 is a statistical measure of the correlation between a fund and the S&P 500. The closer a fund’s r2 approaches that of the S&P 400, the more diversified and less vulnerable it is to disaster in a single stock.

In finance, an r2 above 0.7 or 70 generally shows a high level of correlation, whereas a measure below 0.4 or 40 would show a low correlation. Investopedia offers an in-depth explanation of R-squared for those who wish to educate themselves further.

Look for funds with the same management for at least three years.

A fund’s success or failure depends almost entirely on the skill of its manager or managers. If a fund has switched managers or has a history of doing so, there are no guarantees the new hand at the wheel will drive as smoothly. Notable exceptions to this guideline are funds managed by a group of investment advisors who execute a predetermined investment strategy, rather than relying on the instincts and skills of a single manager.

Just as with top-quality stocks, even renowned funds can lose their way. To employ best-practice guidelines, run your selections periodically through the vigorous criteria listed above. Also, other exceptional funds may emerge that you won’t want to miss out on, so a periodic check of other selections won’t hurt.

If you choose funds that meet these criteria, you’ll make the most of the infrequent but rewarding stock market gains. The time spent doing your research will hopefully (metaphorically and perhaps financially) pay rich dividends for years to come.

No-load funds are easy to cash out of when the PPI generates a sell signal (i.e., rises above 4.25%) because you pay no sales commissions or exit fees. By contrast, a diversified portfolio of individual blue-chip stocks (ten to twelve companies) or a loaded fund will cost you money every time you cash out or buy back in. Given the potential frequency of buy-and-sell signals ahead, it could get quite expensive for investors playing that strategy.

If you follow these simple guidelines, the gains you reap from even the most ordinary no-load stock fund could easily exceed what traders made in the buy-and-hold 1980s and early 1990s.

However, there is one key caveat: the days of buy-and-hold are over.

Getting out of the market at the right time is just as important as getting in. Navigating the stock market’s volatile waters in the coming years will depend on skillful timing, which means keeping your eyes and ears open for inflationary risk!

Get In Touch

Leeb Capital Management offers no-obligation consultations with an investment professional.