How To Invest In Gold

If you’ve been wondering how to invest in gold, there is both good news and bad news. The good news is that you have plenty of options to choose from. The bad news is that with so many choices, it can be challenging to decide which is right for you.

You can invest in physical gold bullion, known as gold bars or coins, purchased directly from mints or refineries. Alternatively, you can invest in a gold ETF or mutual fund, buy shares in gold mining stocks, or even invest in gold futures and options. However, with all these options available, it can be overwhelming, especially if you are new to gold investing. Although gold is often seen as a hedge against risk, each investment option has potential profits. Each has pros and cons, and there is no right way to invest in gold. However, some options may be better suited to mitigate risk.

Fortunately, there are safe and viable ways how to invest in gold that depend on your personal preferences and financial goals. After reading this article, you may decide that investing in gold is not for you. Educating yourself and understanding your options is always good, regardless of your decision.

Tips For Investing In Gold Bullion

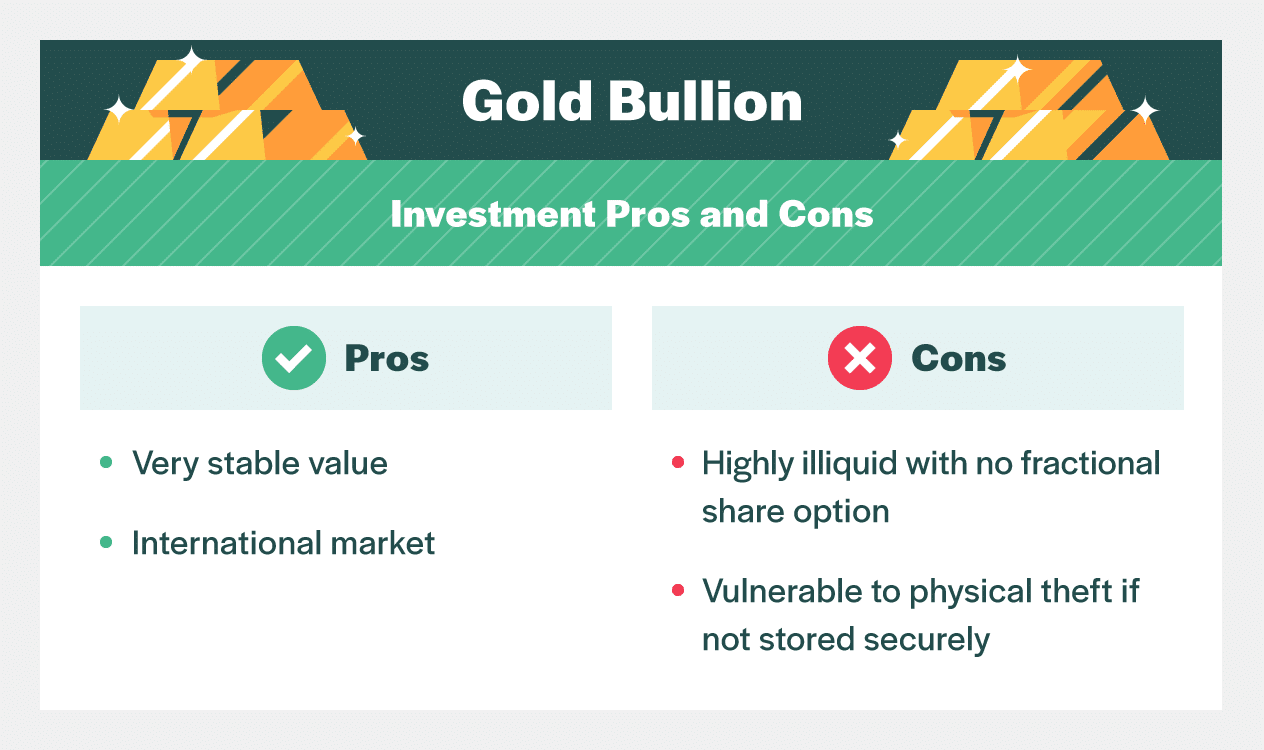

There are two main ways how to invest in gold: physical gold and gold mining companies. In this section, we will focus on investing in physical gold. Many gold enthusiasts believe owning physical gold, or bullion is the best way to benefit from gold’s potential gains. However, owning physical gold also has some complications and is only for some.

Here are some basics to help you decide if it’s right for you. Before investing in physical gold bullion, you should consider the issue of safe storage. While many people consider buying gold and silver bars or coins, they often reconsider when they realize that storage can be both a hassle and expensive. For security reasons, storing bullion in your residence is not a good idea, even if you have a safe. Storing bullion in a safety deposit box at your local bank is also not wise since banks can seize your assets in case of a bail-in. You can choose to store your bullion at an IRS-approved depository. Still, the US Constitution does not protect an investor from the seizure of personal assets such as bullion stored at a depository in the event of a catastrophic economic event. Additionally, storing bullion at any depository incurs monthly/annual fees for storage.

Private vaults, which are not IRS-approved, offer the option of safely storing your bullion. While this may seem like the best option, private vaults typically charge higher fees for privacy and offer non-allocated, segregated storage, meaning that your bullion is segregated and separated from other bullion stored at the facility. Ultimately, it’s up to each investor to decide which option is best for them.

Gold Bars, Rounds, and Coins

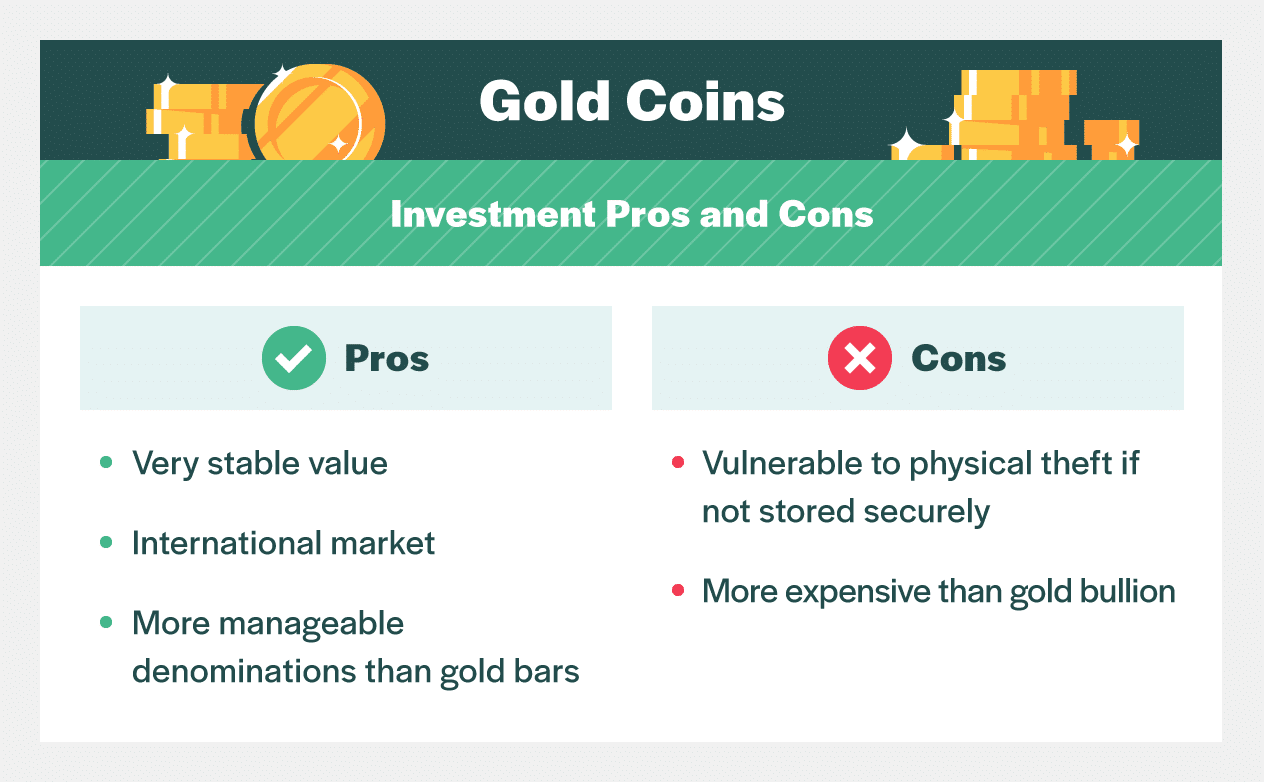

The first thing to realize is that even if you like the idea of owning physical gold, you still have more choices to make. Physical gold comes in different forms: bars, coins, and rounds. Coins are further subdivided into the collectible/numismatic type and contemporary coins.

Mints Verses Refiners

All these forms of gold come in various weights and dimensions and are produced by mints and refiners worldwide. One crucial distinction is between mints and refiners. Mints are either wholly or partly government-owned. They are the only entities officially authorized to produce coins recognized as legal tender.

These coins have a face value, but their actual value is far more significant because of the intrinsic value of the gold that constitutes them. A few of the best-known mints include- in no particular order:

United States Mint

Royal Canadian Mint

Perth Mint of Australia

South African Mint (Rand Mint)

British Royal Mint

The American Eagle, Canadian Maple Leaf, and South African Krugerrand are the most widely popular coins.

Refiners produce bars and rounds (both of which mints can produce) but not coins. Rounds are similar in appearance to coins. However, they aren’t recognized as legal tender since they are issued by private refiners that don’t have a relationship with the government. A few popular refiners include PAMP Suisse, Engelhard, and Credit Suisse.

Understanding Gold Spot Price Flux

Prices of all these forms of physical gold are determined by the spot price derived from the Comex futures market and the London Gold Fix. All bullion products rise and fall in value due to fluctuations in the spot prices. The products sell at a premium to the spot price, with the spread typically narrowing during bear markets in gold and widening when gold is up-trending.

Coins typically sell at a premium to bars. The spread in price between the two usually widens when gold is trending upward and narrows when gold is trending downward. During 2018, when gold was experiencing a correction, the difference between a one-ounce gold bar produced by the Royal Canadian Mint and a one-ounce Maple Leaf coin was $10. The difference was more than $100 in 2011 when gold peaked.

Older gold coins tend to cost more than more recent ones. In addition, coins issued in specific years or with unique designs may be more valuable than standard coins from the most recent year. This may particularly interest those who prefer numismatic gold bullion coins.

Which Option Do I Choose?

Choosing between coins and bars depends partly on what quantity of gold you want to buy. Most coins come in one ounce or less weight, while bars range from one gram to 400 ounces. Because you pay a premium for coins, buying a large bar lets you get the most gold possible at the lowest cost. As an illustration, if the spread between coins and bars is $50 per ounce, and you want to buy 10 ounces of gold, you’d pay $500 more to get that gold in the form of coins rather than in a bar.

But coins have some advantages over bars. They’d be a natural choice if you’re looking to buy just a tiny amount of gold at a time – a fraction of an ounce. In addition, it may be easier to sell coins if you need to cash in. With bars, you may have to offer proof of their purity. Some dealers may require that you pay to have the bars fire assayed, meaning melted down, to validate that they reach the requisite purity level. They may also test them using newer methods like x-ray scanning, ultrasound, or acid testing.

You can avoid worrying about proving purity if you buy bars in a sealed plastic security case with serial numbers and an assay certificate containing bar codes. Look for bars that state they are “In Assay.” Generally, if you stick with bars no more than 10 ounces in weight manufactured by one of the significant mints, there’s no issue. And the path is even smoother if you sell the bar back to the dealer you bought it from (make sure you retain the receipt).

Suppose you’re new to investing in gold and entertaining owning gold bullion. In that case, I’d suggest the most straightforward approach is to stick with coins or bars produced by a reputable refinery or mint and not look for what might seem like better deals from various bullion dealers. It’s worth paying the premium to ensure you’re getting quality.

The Upside of Investing In Gold Mining Stocks

It’s not hype. Honestly, in a significant bull market in gold, if you invest in the right mining companies, you can ultimately make forty to fifty times your money. Maybe even more. Of course, there are no guarantees. You might make “only” twenty times your initial investment, in one mine or overall. And some mining operations might potentially run into environmental permit problems, go bust, or turn out entirely to be a poor investment.

When investing in gold, the best-situated miners offer the most significant leverage to gold’s gains. They’re easy to buy. Some even pay a dividend. You have a range of choices, from the more speculative junior miners to large-cap companies with a proven production record. Even if you want to own physical gold bullion, I’d also suggest investing in some miners. It is always best to diversify!

The key, of course, is to pick the right miners and be sufficiently diversified amongst them so that if one or two don’t pan out, you’ll still be poised for some return on your investment. Identifying the right gold mining company isn’t a matter of luck. Below, I have outlined sensible guidelines for evaluating miners of all sizes for both safety and potential.

What To Look For… Rule #1

An essential rule when evaluating mining companies is to know and have confidence in their leaders’ experience, knowledge, and integrity. That’s important in any investment, of course. But it’s particularly critical with junior miners because so much of what will determine their success is concealed deep underground. Above all, I look for miners whose bosses have outstanding long-term records in the industry.

Rule #2

A second guideline is to focus on junior miners operating in geopolitically safe regions, shielding them from chaos or threats of government takeover. That narrows the field, but – with an occasional exception – it’s not worth incurring the risks of investing in regions particularly vulnerable to violence or other types of disruption. Of course, to some extent, this is a moving target. Chile, for instance, is blessed with natural resources and was once considered one of South America’s most politically stable countries. But the large-scale protests that have recently erupted there have modified that calculus.

Ultimately, with the miners, as with any investment, you’re weighing risks against potential rewards. In the case of any mining stock, the potential rewards range from zero to mega-big.

When seriously considering investing in a mining company, keep in mind there are three basic categories:

JUNIOR MINERS

MID-CAP MINERS

LARGE-CAP MINERS

Investing In Gold Junior Miners

The gold investments with the most significant potential rewards are the small mining companies known as junior miners. These companies own or have substantial stakes in properties known to contain gold and often other precious metals but haven’t yet started mining operations. Many are still in the midst of the long and multi-stage process of obtaining necessary environmental permits, an inescapable task for any miner. Because they are not yet generating earnings, they may need to seek funding to keep the process going, build the necessary infrastructure, and conduct exploratory operations to determine the likely potential of their holdings.

But if investing in junior miners requires a certain degree of faith, the key is to ensure it’s not blind faith. Some junior miners will fall by the wayside, but the ones that make it will reward you many times over, significantly leveraging the rise in gold itself.

These are companies in which you can make multiples of your initial investment in a gold bull market as they go from money-losing companies to producers, in some cases achieving the ranks of primary producers. To cut the risk factor, focus on miners with assets in politically safe regions. Even at current gold prices, each would be profitable shortly after beginning mining operations because production costs below $1,000 per ounce are far lower than what they’d get for their gold sales.

Mid-Cap Miners

The middle of the pack includes gold miners that are both big and small. But that doesn’t mean boring or mediocre. Look for mining companies with solid track records in every metric, from increased production to rising reserves to earnings. Potentially, some may even pay a dividend. While their potential gains are likely less spectacular than for the juniors, a majority have a well-measured long-term target. The Mid-Cap Miner must have a strong balance sheet so that even if gold were to back off to $1,000, they’d still have enough cash to continue to generate growth in their reserves and resources. These medium-sized producers offer an excellent trade-off for investors: less speculative than the juniors but more upside potential than the majors.

Big-Cap Miners

The junior miners are your ticket for the most significant leverage to rising gold prices. But there’s nothing wrong with owning the large-cap, more established miners, either instead of the juniors, depending on how aggressive an investor you are, or alongside them. As with everything, there are trade-offs.

Leverage to rising gold prices comes from the ability to increase production, and the juniors, by definition, will be increasing output since they are starting from no production. The bigger cap mining companies will need to raise production and may see production decline. Still, as gold prices rise, the gold they continue to produce will bring in more money and generate rising profits. And because of their larger size, the more prominent mining companies offer more excellent safety in the event of some out-of-the-blue catastrophic event.

Mining ETFs

An alternative way to invest in miners is an ETF that tracks the industry. For example, here are two typical ETFs that track gold miners.

The first example is VanEck Vectors Gold Miners ETF, which trades on the NYSE under the symbol GDX and encompasses 45 gold stocks, including the major miners. The most prominent miners count the most because it is weighted according to capitalization. The three biggest – Newmont Goldcorp, Barrick, and Franco-Nevada – account for roughly 30% of the ETF.

The second example is VanEck Vectors Junior Gold Miners ETF, which trades on the NYSE under the symbol GDXJ. While “junior” is in its name, the VanEck ETF defines junior miners differently from ordinary perception. Typically, a junior miner has not yet begun production. GDXJ, however, also includes some small junior miners who are already producing.

Wrap Up

So, there you have it. It’s entirely up to each investor whether or not they feel investing in gold is a prudent option for their overall investment objectives. I’d like you to stay tuned for my next article, which dives deeper into the rewards and caveats of investing in gold ETFs.

Get In Touch

Leeb Capital Management offers no-obligation consultations with an investment professional.