How To Identify The Telltale Stock Investing Signals

It’s important to understand that statistics can sometimes be misleading, and this is no exception when it comes to small stocks versus large stocks. While small stocks may have a long-term advantage over large stocks, there’s a critical fact that’s often overlooked: during periods of slow growth and moderate inflation, investors tend to prioritize safety and reliability in the growth of big companies. As a result, small stocks tend to underperform.

When inflation is on the decline and economic growth is slow, companies are forced to compete for smaller and smaller markets. In this environment, big companies with established market positions and larger bank accounts have a significant advantage. They can absorb economic shocks and reduce prices to cut out their competition. Small companies, on the other hand, often struggle to survive during recessions, as big companies have the capitalization to exponentially ramp up sales by expanding their market share. Even if a small company does have a niche market, they could suffer if customers deem their products non-essential.

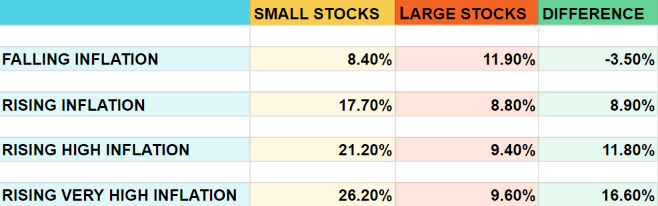

In a slow growth economy, small companies face an uphill battle. This brings us to one of the most important stock investing signals: inflation. Our first table, labeled “Inflation is the Key,” clearly shows that small stocks tend to perform poorly during slow growth environments. Whenever inflation has been falling, small stocks have underperformed large stocks. Therefore, investors should carefully consider the impact of inflation on their investments in small stocks, especially during periods of slow growth and moderate inflation.

INFLATION IS THE KEY

History provides evidence that during full fledged recessions, the gap has widened even more. During the 1972 to 1974 sell-off, large stocks lost on average 35%, as measured by the S&P 400 Industrial average.

That was bad. However, far worse was the catastrophic near 50% loss suffered by the smallest 1/5th of the New York Stock Exchange between February 1972 and December 1974. Many small companies went bankrupt during those years. Likewise, those who did survive, the averages of very small stocks’ lost an astounding 90% of their value.

Much higher inflation in the years ahead is extremely bullish for small stocks, whose profits’ will likely be greater as the economy moves towards its’ peaks.

Unfortunately, the inevitable valleys we hit will almost certainly wipe out all but the strongest small companies, just as they’ve done during past inflationary periods.

When considering stock investing signals to buy; timing your entry into small cap stocks’ is even more important than with big cap stocks.

We have two simple rules for reaping the profits while avoiding pitfalls…

Signal #1

Buy small stocks whenever the annual rate of growth in the CPI rises above 7%

Signal #2

Sell small stocks or stand aside when the CPI growth rate falls below 4.5%

And, of course on the flip side, switch into big stocks when the PPI drops below 4.25%.

Following these key stock investing signals is a historically proven formula for success during inflationary times.

History serves as a measure to anticipate similar future scenarios, helping all who keenly observe to see way ahead of the curve. A perfect example of a relevant financial historical reference mirroring today’s economic climate dates back to April of 1973. CPI growth moved above 7%, obviously triggering a buy signal.

The CPI stayed above 5% for nearly a decade, until November of 1982. During that time period, the average small cap stock scored almost a sevenfold advance… The average annualized gain of 22.6% is amongst the highest long-term returns for any investment ever!

That’s in sharp contrast to the flat returns on big cap stocks.

Perhaps the most remarkable time period was between mid-1976 and mid-1982. During those six years the Dow fell from about 1,000 to 780. As a result, it was a period largely regarded as terrible for almost all big cap stocks, especially with inflation averaging over 9% per year.

Such was not the case for investors that focused on small cap stocks. During those 6 years- the average small stock shares (the smallest 20% of the NYSE) returned an average of over 24% per year. Had you bought the typical small stock, you would have nearly quadrupled your money during those six years.

As a general rule of thumb; when inflation is rising, your portfolio should be weighted toward small stocks’. When inflation is low and simultaneously falling, big stocks’ are the best bet.

There will be times when inflation is rising so fast that it must be tempered. When the Federal Reserve is forced to stamp its foot on the fiscal brakes to prevent a financial hyperinflationary meltdown, small stocks will be amongst the worst possible investments you can own… You’ll want to be long gone!

That’s why we’ve added one additional signal for investing in small stocks:

Sell if the annualized growth rate of the PPI rises above 15%

Should PPI inflation reach that neighborhood, the FED will be forced to take some kind of drastic deflationary action. As the Fed reverses course into QT- quantitative easing– a recession will be unavoidable. A harsh bear market for small stocks will follow.

As long as inflation remains in a long term uptrend, small stocks’ will out-perform big stocks mightily when the market recovers. Once stocks do hit bottom, you’ll want to load up on small stocks’, not big ones.

If you enjoyed this article, feel free to share with a friend or fellow investor… Sharing is Caring!

Get In Touch

Our investment professionals understand that building a wealth management strategy can be overwhelming. Take your first steps toward financial freedom by scheduling a no-obligation investment consultation with a registered investment adviser representative.